Why do Value-added Services Matter for Payments?

In the rapidly evolving world of financial tech, Merchant Services Companies (MSC) are realising that offering value beyond traditional payment processing can make a world of difference, creating additional revenue streams and ensuring long-term client satisfaction. It's not just us saying it—numbers don't lie! According to McKinsey & Company, 70% of small businesses use at least one value-added service from their payments provider, and respondents express interest in purchasing additional services in the future.

Value-added services are those additional offerings that go beyond what customers typically expect. For MSC, the key is to identify what matters most to their clients’ customers and provide them with valuable experiences that enhance their relationship with the brand, and therefore, the MSC itself.

Value-Added Services come in various shapes and sizes. So, buckle up and let's explore together the top five most requested services that MSC should pay attention to in order to expand their solutions and boost profits.

Loyalty Programs

Implementing loyalty programs can significantly enhance client retention for Merchant Services Companies. By offering merchants the ability to create and manage their own loyalty programs, MSC can help businesses build stronger relationships with their customers that will ensure repeat business for them and longer client satisfaction towards the service provider.

According to Accenture, over 90% of the leading companies offer some sort of loyalty program. These programs have proven themselves as invaluable tools, not only for boosting revenue but also for fostering positive brand affinity. Which makes no surprise that a whopping 84% of consumers say they're more likely to stick with a brand that offers a customer loyalty scheme.

This trend marks a clear reference for smaller businesses looking to implement growth strategies to both attract and retain customers.

LoyLap Loyalty Features go beyond simple transactions, transforming each customer interaction into an opportunity for relationship-building. With loyalty rewards such as Credit-Back, Digital Stamps Collection, and Personalized Product-Basket Discounts, merchants of all kinds can make customers feel valued and appreciated for choosing their brand over the competition, creating a genuine connection that goes one step further the transactional aspect, incentivising multiple visits to the same shop.

It’s a win-win situation for both parties involved! Merchant Services Companies stand out by offering extra value, and merchants get the secret sauce to keep customers coming back like clockwork. 🕓

Online Ordering

With the surge in e-commerce, MSC can tap into the growing market by integrating online ordering solutions. Enabling merchants to seamlessly accept online orders and payments with their own white label technology not only caters to consumers’ needs but also significantly improves the client business’ growth, as traditional online ordering and delivery providers charge disproportionate percentages for each order without even sharing valuable customer data, such as user location, demographics, customer behavior, browsing habits, or past purchases.

With LoyLap, MSC can offer clients an online ordering app as an extension of their current register, with all sales data automatically synced for easy accounting, analysis, and reporting. MSC’s clients will be able to understand essential insights that they can use to make more-informed decisions about their customers, offerings, promotions, prices, discounts, and much more.

Advanced Analytics

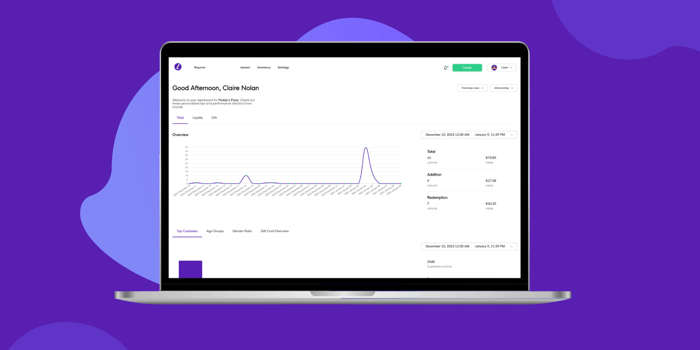

Advanced analytics is a powerful tool that MSC can offer to help merchants gain deeper insights into their business performance. By providing analytics and reporting tools, these companies empower their clients to make data-driven decisions that could significantly improve customer retention and overall profits.

What types of advanced analytics can payment providers offer to their clients through LoyLap?

From understanding top spenders and lost customer rates to easily tracking refunds and spotting patterns in particular customer behavior, LoyLap provides Merchant Services Companies, such as payment providers, with the ability to offer a wide range of analytics that merchants can use to get a comprehensive overview of their sales.

But that’s not all! Besides providing advanced analytics, LoyLap also equips merchants with the tools to turn insights into actionable decisions, ensuring business growth. With the ability to provide analytics and a dashboard to act upon the data provided, MSC can help their clients grow their business with data-driven decisions, improving their results and increasing their satisfaction level towards the service.

Unified Payment Systems

A unified payment system that seamlessly integrates various payment methods can be a game-changer for both merchants and MSC. Simplifying the payment process for businesses and customers alike not only improves efficiency but also enhances the overall user experience, making MSC a preferred choice among other companies in the market.

Physical & Digital Gift Cards

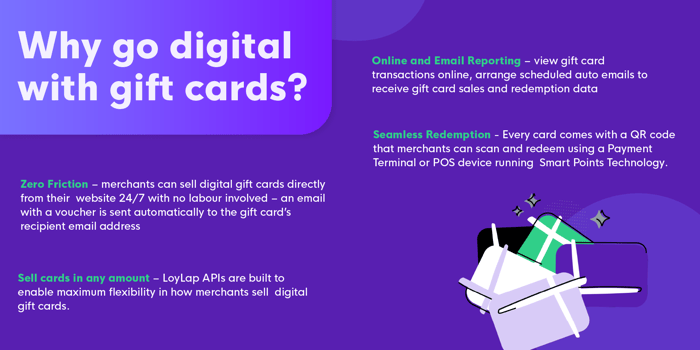

Gift cards are the cool kids in the payment world, with the global market valued at a jaw-dropping $899.3 billion, expected to reach $2.3 trillion by 2030, according to The Global Gift Cards Strategic Business Report 2023 conducted by Research And Markets. Not only are gift cards convenient for increasing revenue, but they also allow businesses to earn more money per sale. Data shows that 61% of consumers spend more than the gift card's value when redeeming, an average of 38% more than the card's value.

With this in mind, 48.5% of the leading online retailers are already accepting gift cards technology that allows them to process redemptions, track gift card purchases and usage, and analyse the different shopping behaviours customers have regarding this payment method.

LoyLap offers the technology necessary for Merchant Services Companies to provide their clients with the ability to sell and redeem gift cards as a value-added service within their contract. With quick implementation, merchants can sell physical and digital gift cards online that are redeemable through QR codes. The process is quick and simple, as they would only have to scan the card using their current payment terminal or a POS device running The LoyLap software.

To wrap it up…

As MSC explores these value-added services, it's crucial to note that developing and maintaining these technologies can be resource-intensive. Partnering with LoyLap offers Merchant Services companies a cost-effective solution, avoiding the high expenses of development, reducing operational burdens, and enabling them to stay focused on core services. Meanwhile, LoyLap handles ongoing maintenance and customer support. As the fintech industry continues to evolve, embracing innovation and collaboration will be key to sustained growth and success.

Reach out today to start discussing a partnership with us that enables your current and future merchants to work value-added services.

Seamless transactional technology, without the headache (and costs!) of in-house development.

.png?width=110&height=53&name=tl%20(1).png)

Leave a comment